Take

flight.

Learn how the TALON platform can bring your organization to full compliance with the Transparency in Coverage Rule and No Surprises Act. Schedule a virtual consultation with us today.

Our Solutions

×

TALON is YOUR solution for price transparency and consumerism in healthcare. We’ve built the ultimate suite of software services designed to ensure FULL compliance with the requirements of the Transparency in Coverage Rule and No Surprises Act, while also leveraging behavioral economics, unmatched benefits expertise, and an unrivaled technology platform to lower healthcare spend long-term and ensure employee access to high-quality care.

MyMedical

Shopper™

- Data derived from actual post-adjudicated medical claims and employer-specific machine-readable files

- Personal health plan integration for real-time deductible tracking and network provider guidance

- By empowering members to shop smarter, healthcare costs are lowered, and health outcomes are improved

MyMedical

Rewards™

- Employees can reduce their out-of-pocket exposure by choosing medical care at or below the given reference price

- Reward is added to employee CDH account (HRA, HSA, etc.), or as an e-gift card, enabled though seamless integration between TPA software and the TALON platform

- The reference price and employee/employer split of the savings are customizable on a per plan basis

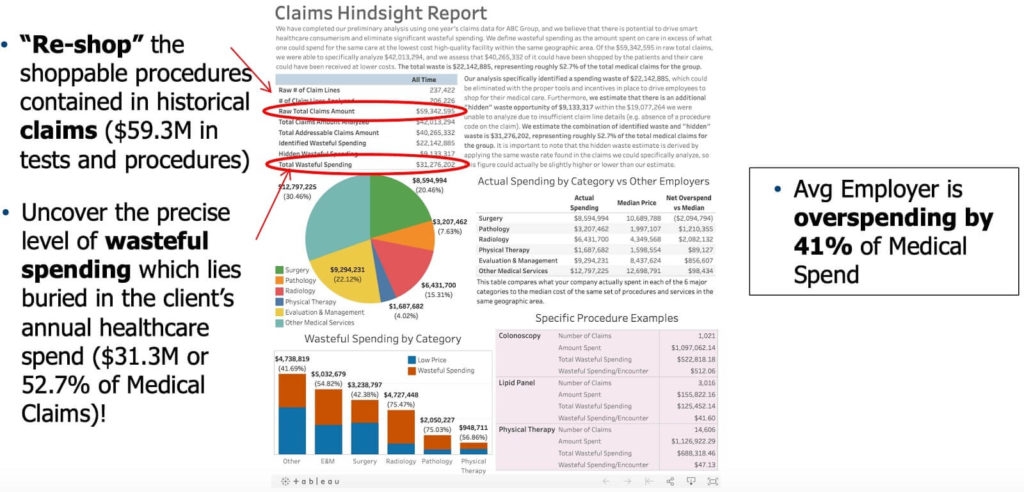

Claims

Hindsight™

- Line-by-line claims analysis

- Cross-reference actual spending against the largest, most complete commercial claims database in the country

- “Re-shop” procedures contained in historical claims

- Cut the waste and see the savings—it’s that simple!

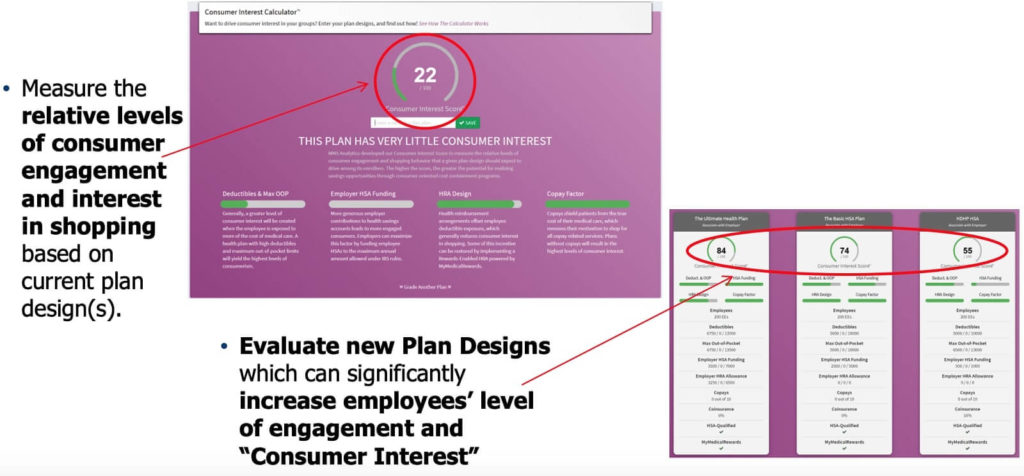

Consumer

Interest Calculator™

- Evaluate new plan designs that will increase engagement

- Employee engagement is essential to keeping costs down long-term

- Price transparency alone will not contain healthcare costs. Employee engagement and incentives are critical!

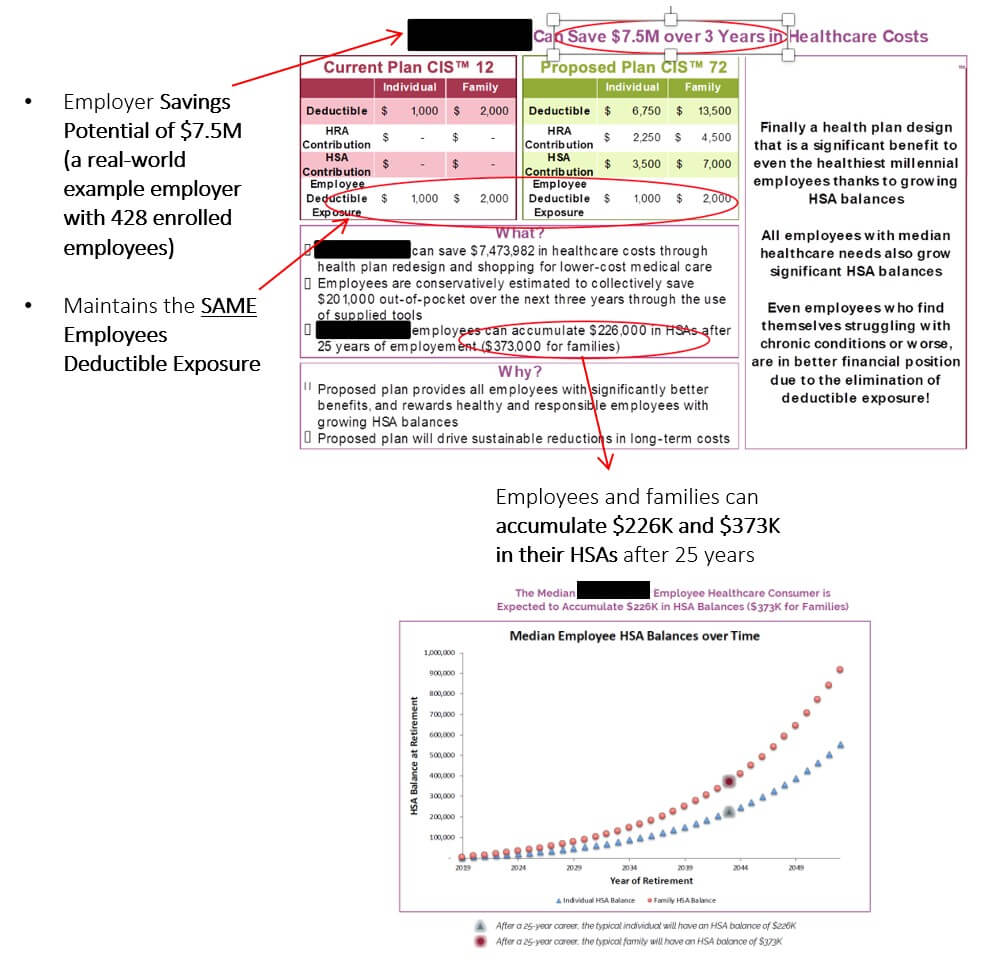

SPARC™

Plan Analysis

- Produce a thorough financial pro forma to model the move from a group’s current health plan to a proposed plan with greater consumer interest and engagement

- Highlight the long-term benefits of plan changes for employees, including projected HSA balance growth

- Make the financial case to adopt a consumer-driven health benefit strategy

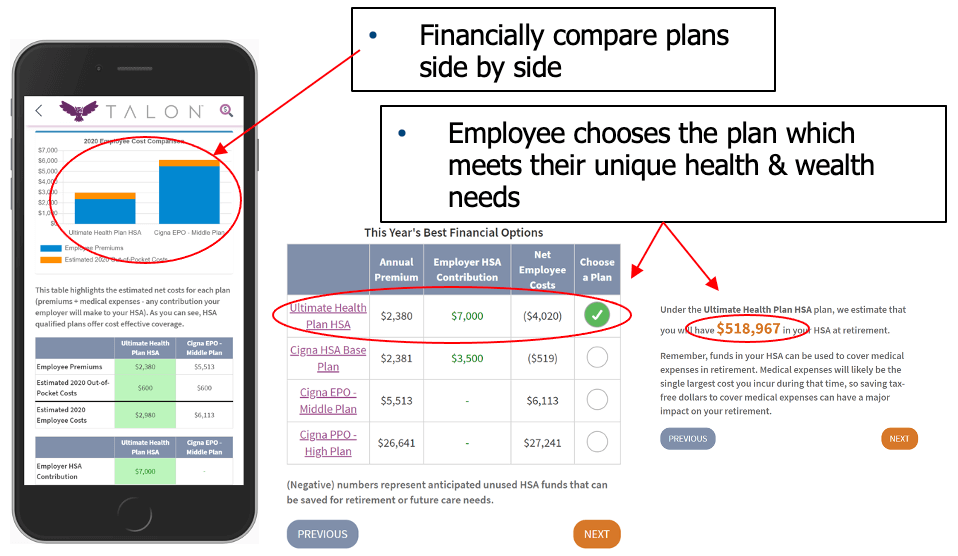

MyPlan

Guide™

- Bring health and financial retirement planning together

- Integrate historical claims costs for future expense projections

- Allow input variables for unplanned medical events

- Provide very low risk level planning for future investments

- Easily compare plans based on net costs to employee

- Project lifetime savings opportunities

- Educate employees on the true value of Health Savings Accounts (HSAs)

MyMedical

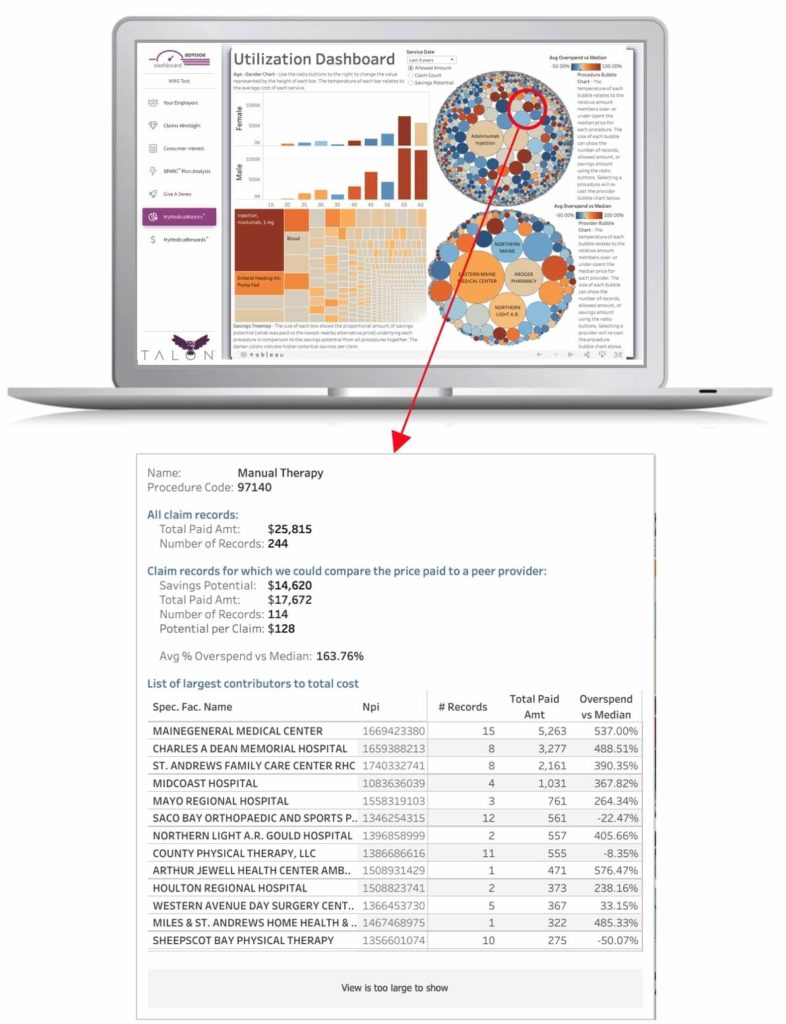

Metrics™

- Tracks aggregate and deidentified medical care consumption

- Compares group claims against regional benchmarks to identify precisely where and how employees are overpaying care

- Reveals specific group savings opportunities

- Detailed summaries of high-cost providers by procedure

- Bottomline™ Reports for actionable insights