By: Mark Galvin

Surprising most within the employer-sponsored health insurance industry, on February 5, 2024, a lawsuit was filed by a class of Johnson & Johnson (JNJ) employees against JNJ and the Pension & Benefits Committee, as well as the committee members.

Notably, the class action complaint lodged against JNJ alleges that the company paid over $10,000 for a medication readily available on the market for $50, nearly a 200% difference. The allegations point to a complete failure by the group’s fiduciaries.

Shortly afterward, a lawsuit filed on April 2, 2024, alleges that the Mayo Clinic health system and its employee health plan violated the Employee Retirement Income Security Act (ERISA) and its fiduciary duties by using pricing methods that are “deceptive, misleading, arbitrary, illusory, unpredictable, and allow for inconsistent reimbursements.”

What has led to this precipitous rise in class action lawsuits against employers regarding their fiduciary practices for health plan offerings?

Before 2024, employers and employees had very little access to understand healthcare costs for prescriptions, services, and procedures, but that all changed with the Transparency in Coverage Rule and the Consolidated Appropriations Act of 2021 (CAA). Those two legislative efforts had a material impact on the role and responsibilities of human resources (HR) leaders’ fiduciary practices going forward.

Employers and their employees across the country struggle with healthcare costs, with annual family premiums for employer-sponsored health insurance climbing 7% on average for 2023 to reach $23,968, which is a sharp departure from virtually no growth in premiums throughout 2022.

Over the past five years, health insurance premiums rose 22%, in line with wages (27%) and inflation (21%). As articulated by KFF President and CEO Drew Altman, “Rising employer health care premiums have resumed their nasty ways, a reminder that while the nation has made great progress expanding coverage, people continue to struggle with medical bills, and overall the nation has no strategy on health costs.”

HR leaders must prepare their health cost strategy today to protect themselves from litigation, financial penalties, and irreparable damage to their reputations.

1. Demand Access to Your Group’s Claims and Attest to it

Plans cannot enter into any agreement with healthcare providers, network of providers, third party administrators (TPAs), or others who offer access to a network of providers if that contract would, directly or indirectly, preclude the plan from:

- Disclosing provider-specific cost or quality-of-care information or data through a consumer engagement tool or other means to referring providers, the plan sponsor, enrollees, or individuals eligible to become enrollees;

- Electronically accessing de-identified claims information (in accordance with HIPAA (Health Insurance Portability and Accountability Act), GINA (Genetic Information Nondiscrimination Act), and the ADEA (Age Discrimination in Employment Act));

- And share the above information with a business associate.

By December 31, 2023, health plans and insurers must have submitted an attestation of compliance with the anti-gag rules of the CAA. The rules apply to all agreements entered into on or after the date that the CAA was enacted (December 27, 2020), and the first attestation applies retroactively to that date. Beginning in 2024, the CAA requires plans and insurers to attest annually to their compliance with this provision by December 31 each year.

Role & Responsibilities of HR Leaders

With the prohibition of the gag clause mandate within the CAA, employers have a right to their claims data. HR leaders must ask, “Can I attest that I have access to this data? And is this data being reviewed annually to understand the group’s trendline compared to benchmarking standards?”

2. Understand What You and Your Organization Are Paying for

In addition to the prohibition of gag clauses, the CAA of 2021 added specific disclosure requirements for group health plans so that a contract for brokerage services or consulting will only be considered “reasonable” if certain disclosures are made by the service provider to the plan.

This requirement only applies to contracts where the service provider reasonably expects to receive $1,000 or more in compensation (direct or indirect) in connection with providing the services. Specifically, these rules will require the disclosure of, among other things, whether the service provider will provide fiduciary services and the direct and indirect compensation received by brokers and consultants related to the health plan, such as for steering plans to certain vendors.

An example of the type of compensation that must be disclosed to plan sponsors is when a consultant may receive a commission or production bonus from a TPA for business placement with that TPA.

Role & Responsibilities of HR Leaders

HR Leaders must review their existing group health plan service provider agreements to determine whether a broker or consultant has/should disclose fees under the CAA-21. Once received, HR Leaders must ensure that they carefully review the disclosure, fully understand what the plan and their employees are being charged, and act accordingly.

3. Hold Yourself Accountable… or Someone Else Will

Group health plans and health insurance issuers of group and individual coverage must provide the Departments of Labor, Treasury, and HHS (Health and Human Services) with certain information regarding costs associated with the plan’s prescription drug benefit. The first report is due by December 27, 2021, and subsequent reports are due no later than June 1 of every subsequent year.

The information that must be included in this report includes:

- the beginning and end dates of the plan year,

- the number of participants and beneficiaries in each state in which the plan is offered,

- the 50 brand prescription drugs most frequently dispensed (including the number of paid claims for those drugs),

- the 50 most costly prescription drugs by annual spend (including the annual expenditure amount for those drugs).

Role & Responsibilities of HR Leaders

This data must be used in any future request for proposal, as it will allow HR leaders to understand what it has paid for and what it is likely to pay for and practice reasonable prudence in ensuring and delivering value. It is likely that potential plaintiffs’ lawyers will be looking carefully at this data as a basis for class action lawsuits.

Additionally, if a high-deductible health plan is offered, HR leaders must know the prices associated with services and prescriptions and validate that participants are not grossly overpaying for prescription drugs before reaching their deductible. Again, the potential plaintiff’s lawyers will likely be for and verifying this sort of data.

4. Transparency Begets Trust

As mentioned earlier, the federal government also issued the Transparency in Coverage final rule in 2020, with rolling effective dates from 2022 through 2024. This rule requires group health plans to disclose two machine-readable data describing payment rates for in-network healthcare items and services and out-of-network allowable amounts, with a potential third file to be published highlighting the prescription drug costs.

These data files make healthcare pricing information accessible to participants, helping them know the cost of a covered item or service before receiving care. Like the fee disclosures, this transparency in coverage data is also helpful in determining whether plan fees are reasonable under ERISA’s fiduciary rules, potentially supporting excessive claims litigation.

Role & Responsibilities of HR Leaders

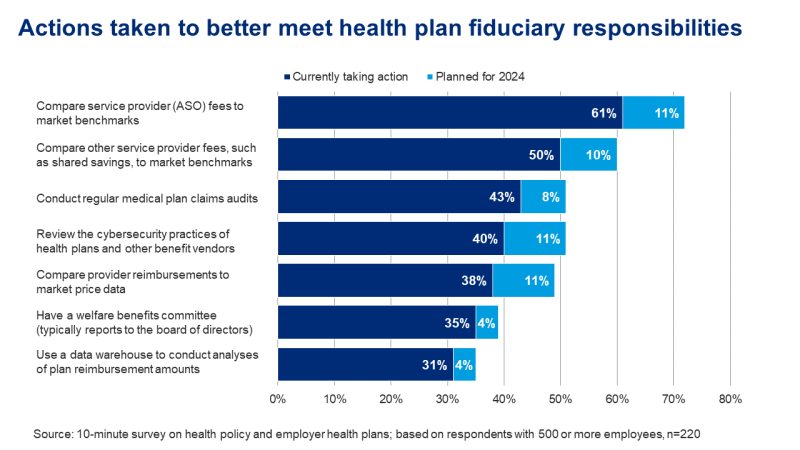

Access to accurate, precise data is the best level of protection. HR leaders must establish a process to review and monitor their group health plan fees, ensuring they are reasonable based on the services received and in relation to industry standards.

This will require HR leaders to periodically run their group health plan’s data through benchmarking and market comparison analysis to help determine whether their participants are receiving the best services at a reasonable cost.

The steps listed above highlight that this is a problem of will, not skill. HR leaders must contribute to company culture, financial well-being, and wellness. However, HR leaders should not feel that this is done alone. Establishing a health plan fiduciary committee and adopting a committee charter that sets forth its responsibilities, documents its findings, and lays out its steps to resolution are foundational practices of a fiduciary-minded HR organization.

The risks of avoiding these efforts are far outweighed by the risks of finding your organization’s name in the headlines.