In the next blog post within the TALON price transparency series, we will highlight why incorporating healthcare price transparency data will provide competitive insights and symmetrical information in the market for all key stakeholders.

Introduction to Blog Series:

Transparency in healthcare pricing has finally arrived with the passage of January 1st, 2024. The series of actions that have led us to this point goes as far back as the implementation of the Affordable Care Act, but more recently include the implementation and enforcement of the Hospital Transparency Rule, the No Surprises Act as part of the Consolidated Appropriations Act of 2021, and most notably (although not widely covered) the Transparency in Coverage Rule.

We’ve seen enforcement and resultant fines upon healthcare providers due to non-compliance with the Hospital Transparency Rule. Given the bipartisan and bicameral support healthcare transparency receives, active enforcement of the Transparency in Coverage Rule requirements will be seen throughout 2024 into 2025, where non-compliant actors will face business crippling penalties, loss of trust and credibility, and reduced revenue. The age of opaque healthcare pricing is nearing its end as the exorbitant healthcare costs borne by consumers have served as an important impetus for systemic change in the U.S. healthcare system.

With transparent healthcare pricing now available, what opportunities will come to light as a result of this massive data? For the first time in the American Healthcare System, symmetrical pricing information between and amongst stakeholders is publicly available. Therefore, the question must be asked – Who will recognize this opportunity and leverage it to their benefit and advantage?

In this blog series, TALON will help readers understand the new reality of transparent healthcare pricing, highlight its impact on the American Healthcare System, and outline how this data should be used for the benefit of all.

In the previous blog post within this series, we highlighted that consumer navigation and steerage within the complex landscape of the American Healthcare System used to mirror the days of the sextant and the study of the stars. As much as the consumer may get to where they need to be, they inevitably face significant confusion, struggle, frustration, and in some cases, their financial downfall. Now, healthcare pricing navigation tools allow the consumer to confidently navigate throughout their journey.

In our second blog post, we will highlight why all stakeholders need to leverage healthcare price transparency data as a strategic pillar within their operations.

With Big Data Comes Big Responsibility

In the ever-evolving landscape of the American healthcare system, the importance of transparency cannot be overstated. Especially because we’ve never had this level of price transparency before 1/1/24. The promulgation of the Transparency in Coverage Rule and the Consolidated Appropriations Act of 2021 has ushered in a new era, one where the power of transparent healthcare pricing data is set to revolutionize the industry. This legislative milestone is not just a win for transparency; it’s a leap toward more informed decisions, equitable access, and ultimately, a more efficient healthcare system. Healthcare stakeholders now stand at a crucial juncture – will these stakeholders recognize and harness the power of the data now available to them, or will they continue to accept the unsustainable status quo until the system fractures under its own weight?

Empowering Employers and Employees

For employers, truly transparent healthcare pricing is a game-changer. The availability of comprehensive pricing data allows businesses to make more informed choices about the health plans they offer, ensuring that they provide both value and affordability to their employees. Price transparency enables employers to negotiate better deals, tailor benefits more effectively, and manage healthcare costs more efficiently, leading to savings that can be reinvested in the workforce.

Employees also stand to gain significantly from this newfound clarity. With the ability to easily compare costs for various medical services and procedures, individuals can make choices that best suit their needs and budgets. This level of potential empowerment is unprecedented, fostering a sense of control over one’s healthcare journey and encouraging engagement with healthcare services in a more proactive and informed manner. This also means greater control of the budget, which has been eaten away by health insurance premiums, currently at just under 20% of their total compensation.1 Just like the US GDP.2 An interesting coincidence, isn’t it?

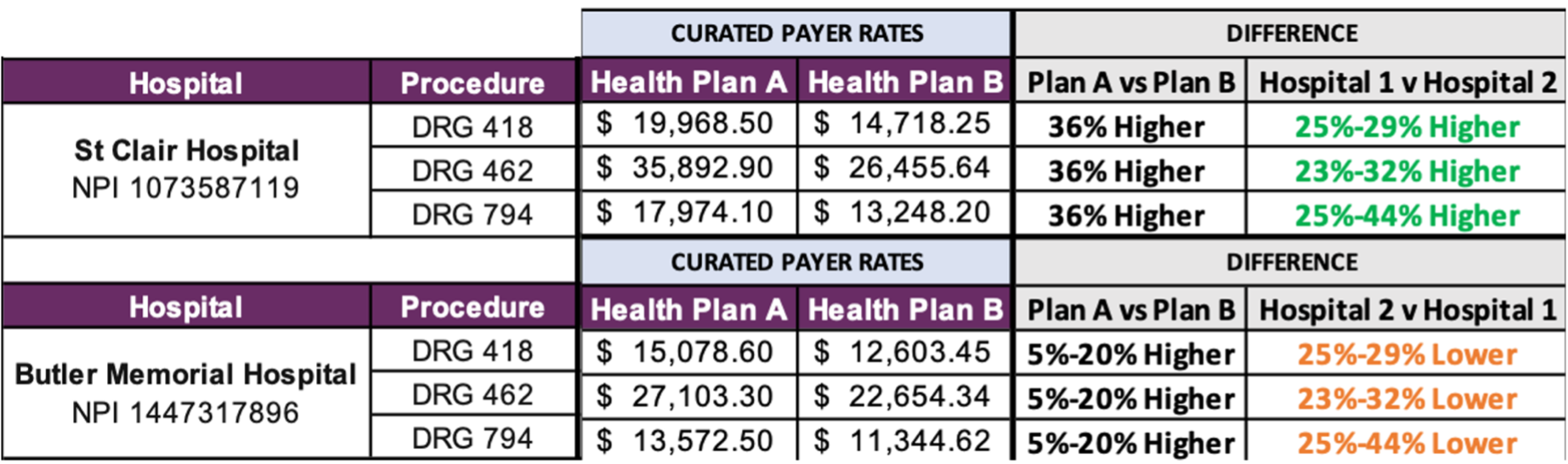

Ask any consumer, do they know where to go for healthcare services? Are they aware of the drastic price variation that exists between in-network providers for the same exact procedure? Or that price and quality have an inverse relationship within healthcare?

Hidden variations in healthcare “discount” prices

(negotiated discount, same procedure, different providers)

| Procedure | Boston (50-mile radius) | ||

| Low Price | High Price | Variation | |

| Diagnostic Colonoscopy (45378) | $665 | $2,593 | 390% |

| MRI Lower Joint (73720) | $470 | $2,056 | 437% |

| Ultrasound of Neck (76536) | $144 | $640 | 444% |

| Rotator Cuff Repair (23410) | $2,536 | $12,140 | 478% |

| Nuclear Stress Test (78452) | $600 | $3,055 | 509% |

| Chest X-Ray (71046) | $32 | $324 | 1009% |

| Thyroid Stimulating Hormone (84443) | $14 | $169 | 1207% |

| ER Visit (99283) | $129 | $1,564 | 1212% |

| Cholesterol Screening (80061) | $12 | $153 | 1275% |

The Cost of Inaction

But what happens if nothing is done with this new, incredibly valuable data and the insights it can generate? If the opacity of the healthcare system remains as it is? In 2023, annual family premiums for employer-sponsored health insurance climbed 7% on average to reach $23,968.3 Over the past five years, premiums rose 22%, in line with wages (27%) and inflation (21%).3 In the next five years, the expected growth in health spending for private insurance in the U.S. is projected to average 5.4% annually.4 Employers cannot afford (literally) to be complacent. Failure to rise to the occasion and address these costs could lead to significant challenges, including potentially business-crippling class action lawsuits. As evidenced by the recent case concerning Johnson & Johnson, who was sued by an employee for allegedly overpaying its pharmacy benefit manager for its employees’ medicines. Those overpayments, the lawsuit alleges, ultimately come out of workers’ paychecks in the form of high health insurance premiums, higher out-of-pocket drug costs, and stunted wage growth. One example cited within the lawsuit states that J&J paid its PBM more than $10,000 for a single 90-day prescription when that same 90-day prescription could be purchased for as little as $30 elsewhere.5 This sort of wild price variation runs rampant within healthcare, notably between in-network providers for the same exact procedures (see above). Employers are on the hook as fiduciaries and will continue to be under the spotlight assessing if they are practicing reasonable, prudent purchasing on behalf of their employees. With Big Data comes Big Responsibility.

Revolutionizing Health Plans and Health Systems

Health plans and health systems are also navigating this shift, with the mandate pushing them towards greater transparency in their pricing structures and coverage details. This move not only promotes competition based on value and service quality but also compels health plans to innovate and improve efficiency to remain competitive. As consumers become more discerning, health plans are incentivized to offer products that are not only cost-effective but also aligned with the needs and preferences of their members. Member-centricity is the top priority for the healthcare industry. This member-centric environment fosters a competitive market where efficiency, quality, and member satisfaction are paramount, driving down overall healthcare costs and improving outcomes.

But what happens if this data is not leveraged by health plans and health systems? Or if only a select few choose to use this data? The new era of transparency leads to ongoing regulatory pressure, increasingly public negotiations, and consolidation activity continuing to grow.

There have been 14 civil monetary penalties to date against healthcare providers for failing to provide transparent pricing, totaling over $4 million.6 There have yet to be any fines levied against non-compliant plans for the Transparency in Coverage Rule, but the exposure is overwhelming, as the fines are set at $100 per affected member per day.

On top of the regulatory pressure, the industry is also seeing a rapid increase in public disputes. As reported by FTI Consulting, there has been a 91% year-over-year increase in media coverage of negotiating conflicts between payers and providers.7 This all comes at the expense of the employer and employee as consumers, who face increased costs, lower quality of care, fractured care coordination, and limited access.

2023 M&A deals in healthcare increased by 22% as a result of the inflationary carnage of the past year creating an increased need for pricing power and scale.8 Price transparency data is a necessary data element to inform M&A and market expansion strategies by enabling clearer valuation.

Regulatory pressure, increasingly public negotiation disputes, and rampant M&A activity are all being driven by the availability of price transparency data. This data can level up the playing field and ensure that all parties – consumer, payer, and provider – are equally represented and equipped to ensure high-value care delivery to, from, and amongst competitive stakeholders. With Big Data comes Big Responsibility.

The Road Ahead

While the implementation of transparent healthcare pricing data presents challenges, the benefits far outweigh the hurdles. Employers and employees can create a more collaborative relationship in managing healthcare benefits, with transparency acting as the foundation for trust and informed decision-making.

Health plans and health systems must adapt to this new reality, where the emphasis on value and patient-centric care becomes the norm rather than the exception. Innovation in service delivery, pricing models, and member engagement strategies will be key to thriving in this transparent healthcare ecosystem. None of this can be built without first laying down price transparency as the foundation.

The Transparency in Coverage Rule and the Consolidated Appropriations Act of 2021 laid the groundwork for healthcare stakeholders. As we navigate this new era, the potential for a more equitable, efficient, and patient-focused healthcare system is within our grasp. The rewards—a healthier, more informed, and engaged population—promise to redefine the healthcare landscape for generations to come. Are you ready to take part in redefining healthcare for future generations? Remember, with Big Data comes Big Responsibility.

Sources:

1 https://www.americanprogress.org/article/health-insurance-costs-are-squeezing-workers-and-employers/

2 https://www.statista.com/statistics/184968/us-health-expenditure-as-percent-of-gdp-since-1960/

3 https://www.kff.org/report-section/ehbs-2023-summary-of-findings/

5 https://insurancenewsnet.com/innarticle/jj-drug-pricing-lawsuit-seeks-class-action-status

6 https://www.cms.gov/priorities/key-initiatives/hospital-price-transparency/enforcement-actions