The Fiduciary Blind Spot

Employer group fiduciaries have never faced greater pressure or greater scrutiny concerning their healthcare budget.

The Consolidated Appropriations Act (CAA) of 2021 and the Transparency in Coverage (TiC) Rule fundamentally shifted responsibility for healthcare cost oversight onto plan sponsors. No longer can CFOs, controllers, or benefits committees rely solely on reports from their health plan, TPA, or ASO. The expectation is clear: fiduciaries must demonstrate prudent oversight of their plan’s spending decisions and prove they are acting in the best interests of their employees.

Yet most employers are still flying blind, adhering to the status quo, unable (or perhaps in some cases, unwilling) to break free.

Traditional reports from employer groups’ plans or administrators show costs, but not causes. They summarize claims totals without surfacing the root drivers of overspend or providing actionable levers to control it. That’s not active oversight, it’s passive observation. And passive observation allows for entities to be acted upon, instead of being proactive. More importantly, this level of observation alone no longer satisfies fiduciary standards.

The Transparency Imperative

In 2026, medical costs are projected to climb nearly +10%, the steepest rise in 15 years, according to The Wall Street Journal. For self-funded employers, that trajectory threatens margins, weakens competitive positioning, and exposes fiduciaries to avoidable risk. Studies estimate that 25–30% of all healthcare spend is wasteful or avoidable, often hidden in opaque provider contracts and unmanaged utilization.

Fiduciaries are accountable for that waste, even if they can’t see it.

That’s where MyMedicalMetrics (MMM) changes the equation. Built by TALON, MMM delivers the visibility fiduciaries need to manage healthcare costs as responsibly as any other line item on the balance sheet. It provides real-time analytics across spend, utilization, population health, and member engagement, empowering leaders to see exactly where dollars are being lost and how to reclaim them.

From Claims Chaos to Clarity

MMM unifies data from multiple sources, including claims, eligibility, negotiated rates, and engagement metrics into a single source of financial truth. The platform benchmarks every dollar of medical spend continuously throughout the plan year.

The result:

Fiduciaries can finally see –

- Which 20% of members drive 80% of total spend

- Where overspend is concentrated—by procedure, provider, or site of care

- Which interventions yield the highest ROI

In other words, you gain the same financial instrumentation for healthcare that you already use in corporate finance.

Behavioral Economics, Measured in Dollars

A key differentiator of MyMedicalMetrics is its integration across TALON’s transparency ecosystem:

- MyMedicalShopper™ – real-time price comparison and transparency tools

- MyMedicalRewards™ – patented incentive programs that reward smarter decisions

- MyMedicalMetrics™ – analytics that quantify those behavioral outcomes

When employees shop for care, MMM records the event and tracks its financial impact. Data consistently show that shopped procedures cost significantly less than unshopped alternatives without any reduction in quality or access. This makes behavioral economics tangible: fiduciaries can observe, measure, and report how individual actions reduce plan liability in real dollars.

Pinpointing Value Levers That Matter

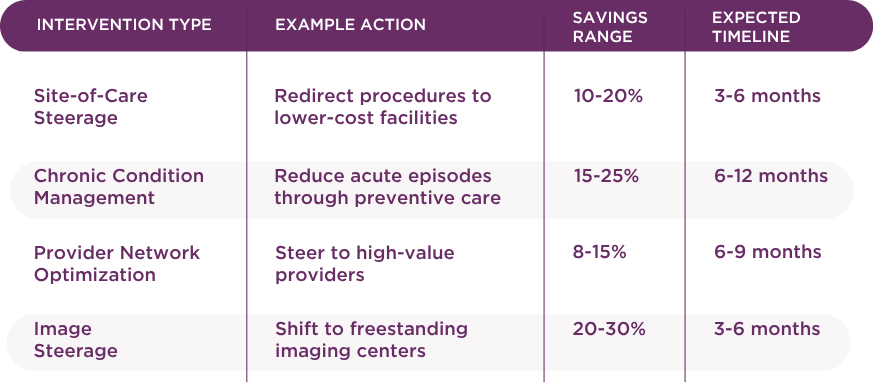

MMM doesn’t just identify overspend, it prescribes action. Each analytic view links directly to specific cost-reduction interventions proven to generate results:

For fiduciaries, this transforms cost containment from a buzzword into a portfolio of measurable, time-bound financial initiatives.

ROI You Can Audit

The financial case for MMM is straightforward and defensible: A typical employer with $10 million in annual claims identifies 8–10% addressable waste and realizes roughly $400K–$500K in net annual savings, achieving ROI within 12 months

Every insight in the platform can be tied to a verifiable action and result:

- Imaging overspend flagged → steerage program → $150K saved

- High-cost claimant identified → case management → reduced readmissions

- Member engagement increased → 5% lower cost trend year-over-year

This is fiduciary accountability made measurable. CFOs and controllers can document not only where the plan spent its money, but how that money was recovered through prudent action.

Low Lift, High Impact

Implementation is frictionless. TALON manages technical integration end-to-end, requiring minimal IT resources. Most employers are fully implemented within 4–6 weeks.

That means fiduciaries can fulfill transparency and oversight requirements faster than any compliance audit cycle.

Fiduciary Assurance Built In

Beyond financial performance, MMM enforces data privacy and regulatory compliance:

- HIPAA-compliant with PHI encrypted in transit and at rest.

- Role-based access for employer, advisor, and fiduciary users.

- Weekly audit logs ensure every data access event is traceable.

For fiduciaries, that means every report, every trendline, and every insight meets both financial and regulatory standards of prudence.

From Compliance to Confidence

The CAA and TiC Rule didn’t just create new compliance obligations; they created new opportunities. Employers now have the legal authority and the fiduciary responsibility to demand data transparency from their partners. MyMedicalMetrics ensures they can actually use that data to make informed, evidence-based financial decisions.

- When you can see every dollar, you can defend every dollar.

- When you can measure outcomes, you can prove diligence.

- When you can demonstrate prudent spending, you fulfill your fiduciary duty.

That’s the power and necessity of MyMedicalMetrics.

Next Steps for Fiduciaries

Provide 12 months of de-identified claims and eligibility data, and receive a complimentary baseline-to-savings analysis.

Low risk. High impact. Complete transparency.

Learn more at TALONhealthtech.com/MyMedicalMetrics

Disclaimer: Savings results vary by population mix and engagement level. Illustrations are examples only and not performance guarantees.