Matthew McCormick, Director, Partner Sales

Having spoken with and met hundreds, if not thousands, of employee benefit brokers, I’ve noticed a recurring, fundamental theme runs through our discussions: .. Many within the healthcare space have been led astray by nostalgia.

Nostalgia is a beautiful word It brings back fond memories. It evokes a sense of tradition. It makes change seem like a loss.

It isn’t that stakeholders in the health insurance industry aren’t searching for change. But change is hard. There’s friction. There’s disruption. And while disruption is sought after in nearly every industry, in healthcare—especially the employee benefits space—disruption implies interfering with the beloved status quo.

Many benefit brokers that I have met with have shared this sentiment from their clients and prospects:” Back in the day, you could slap down (it’s always slap, never place or hand over) your insurance card and everything was taken care of. No financial consideration necessary.” I have no memory of this experience, as, in those days, I was a dependent, relying upon my parents’ plan. Growing up, my knowledge concerning healthcare costs started and ended at the word co-pay, only encountered after visiting the doctor and getting my lollipop.

This sentimentality for the past (for the insurance card as a free pass to health care, not for the lollipop ) has effectively clouded the views of many as to what should unfold in healthcare in the future.

I won’t disagree, slapping down an insurance card and bearing no or next to no financial responsibility for the cost of health care services does sound like the good old days. But,, fortunately or unfortunately, the good old days are well behind us, and this locomotive known as the healthcare industry isn’t slowing down. When I was born, national health expenditures reached $786 billion, or $2,868 per person, or just over 13 percent of GDP. In 2019, national health expenditures reached $3.8 trillion, or $11,582 per person, or 17.7 percent of GDP. Choo Choo.

Isolating these figures to employer and employee statistics, we see a very similar story. Heck, since I’ve joined the workforce, the average premium for family coverage has increased 55 percent, and the average general annual deductible is 111 percent higher, jumping from $646 to $1,364.

Yet nostalgia continues to creep into the discussion regarding health plans. And that’s an issue. Because offering low deductible plans with a bevy of copays is not only extremely expensive in terms of employer and employee contributions to premiums, it also creates a cycle of financial destruction. Employees with little or no financial stake in the game will navigate to providers who are merely convenient, with no consideration as to cost. Receiving care at higher-cost providers will beget a higher total cost of claims, which will inevitably lead to a double-digit rate increase for the following year.

Am I saying employers should get rid of co-pays, jack up deductibles, and get their employees to have (I hate this terminology as much as you do, but it’s just applicable) “skin in the game?” Yes, and no.

Let’s look at the two basic levers of health insurance costs: Premiums and deductibles. In most cases, the relationship between the two is pretty simple:

- Lower deductible = higher premium

- Higher deductible = lower premium

Some would call the logic above an inverse relationship. I advocate, and will always advocate, for the high deductible plan. I also advocate, and will always advocate, for the zero out-of-pocket exposure plan. Many would think those are diametrically opposed. Let me help clarify why many are wrong.

The information I’m sharing below is my actual plan design.

As you can see below, my deductible is $5,500. That might seem like it would be scary for most individuals—or anyone paying for an individual’s health care insurance.. At that deductible level, an insured individual would, in essence, have catastrophic insurance coverage. But his or her total premium would be pretty low, coming in at around $2,800 per year. That’s about $5,000 dollars less than average premium for both HMO and PPO Single Coverage. So, what should be done with that dividend?

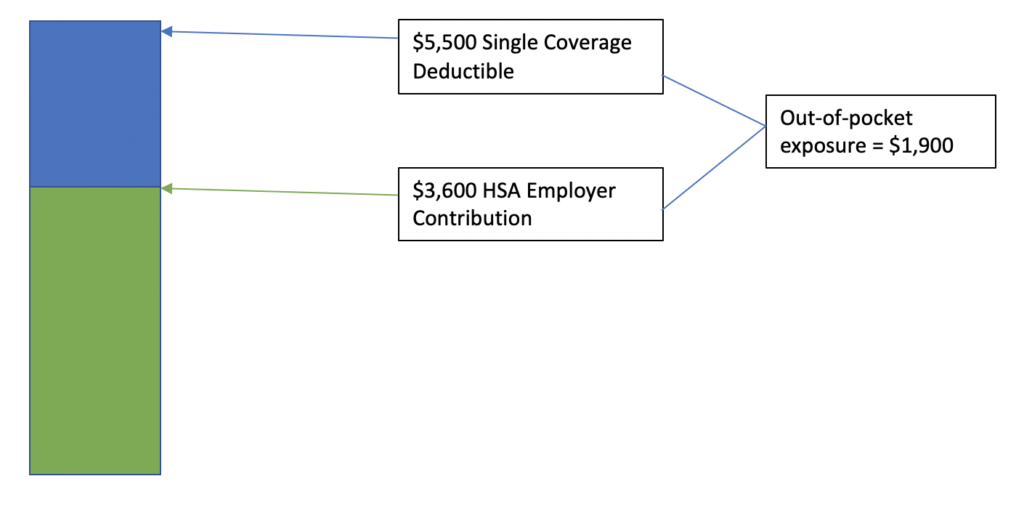

Well, let’s take that dividend and reinvest it to fund the individual’s (or employee’s) HSA. Now what does the deductible stack look like:

Above, I said high deductible, zero out-of-pocket exposure plan, and, yet, we still have $1,900 in out-of-pocket exposure. How can we cover that, and still ensure deductible security?

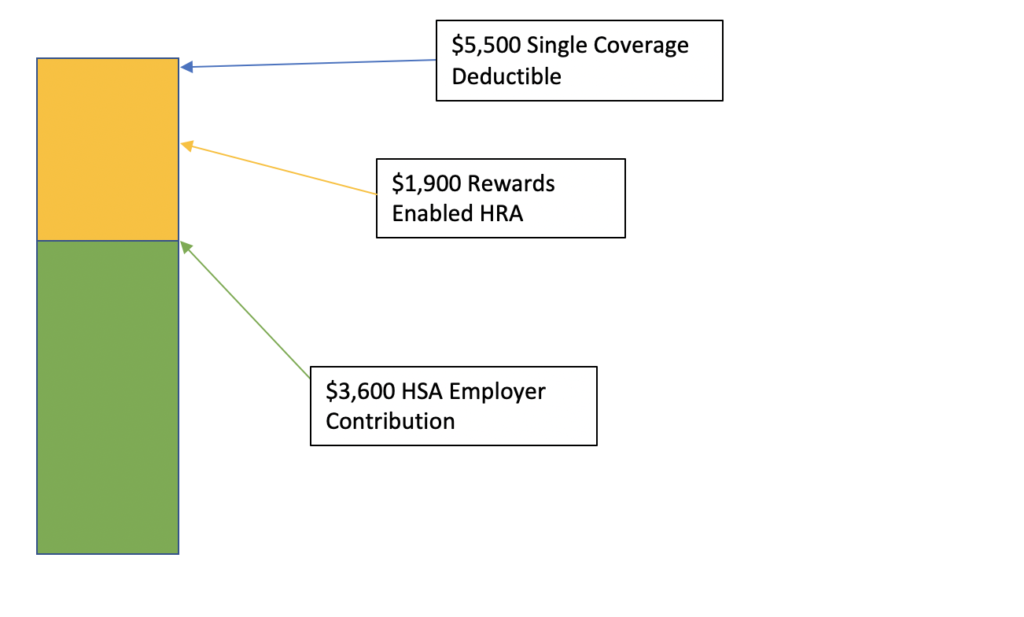

And there we go! High-deductible health plan, zero out-of-pocket exposure. Something that we here at TALON refer to as The Ultimate Health Plan. Throughout the year, if I need healthcare services, I can economically consume my employer-funded HSA and, with a patented rewards program in place, earn rewards into my HRA for future medical expenses.

The above plan design would inevitably cause disruption. But I contend it’s creative disruption. It creates optimism for the future. HSA funds growing, adequately preparing individuals and families for healthcare costs into retirement. Looking forward, not backwards.

Let’s not let nostalgia, like co-pays, obfuscate our perspectives on health plans and healthcare costs. Let’s embrace our current obstacles within the byzantine healthcare system and disrupt the paradigm that has burdened employers and employees for too long. There are compliance requirements coming down the pipeline for employers, like the Transparency in Coverage Rule and the No Surprises Act, that are going to uncover a treasure trove of valuable healthcare cost data. Within these compliance obligations, there’s incredible opportunity, if they’re leveraged correctly.

Let’s make sure we never overpay for healthcare, again.