A little background information:

When the Affordable Care Act was launched in 2011, it included a new rule for governing the Medical Loss Ratio (more information on the MLR here) for health insurance companies. It’s become commonly known as the “80/20 rule,” and it’s gotten quite a bit of press lately. The objective of the rule was to limit how much insurance companies could charge for premiums, subsequently lowering costs for healthcare consumers. Basically, it requires health insurance companies to spend at least 80% of their annually collected premiums on your actual healthcare (along with some other expenses related to improving the quality of patient care). It should be noted that while the 80/20 rule gets most of the attention, many large employer pools are actually subject to an 85/15 rule (and before the ACA went into effect, there were other defined limits on the MLR for insurance companies).

Now the real story:

The White House has been touting the success of the 80/20 rule, citing nearly $2 billion in refunds since 2011, including an estimated $330 million returned to over 6.8 million health insurance customers in 2014 (read more on their claims here). While it’s nice to see insurance companies returning excess premiums to their policyholders, these refunds are just a narrow view of the overall picture—a view that neglects the economic reality of these regulations. It’s a view that fails to see the larger consequences of this part of the ACA that were probably never imagined by the legislators, much less intended by them.

So what exactly are these “unintended consequences” of the 80/20 rule? While the objective was to make premiums lower for healthcare consumers (a mission with strong merit, for sure), it has instead removed any incentive for the health insurance companies to drive down the total value of medical claims. Let’s take a look at a couple of graphics that illustrate this misalignment of incentives, courtesy of the team at MyMedicalShopperTM:

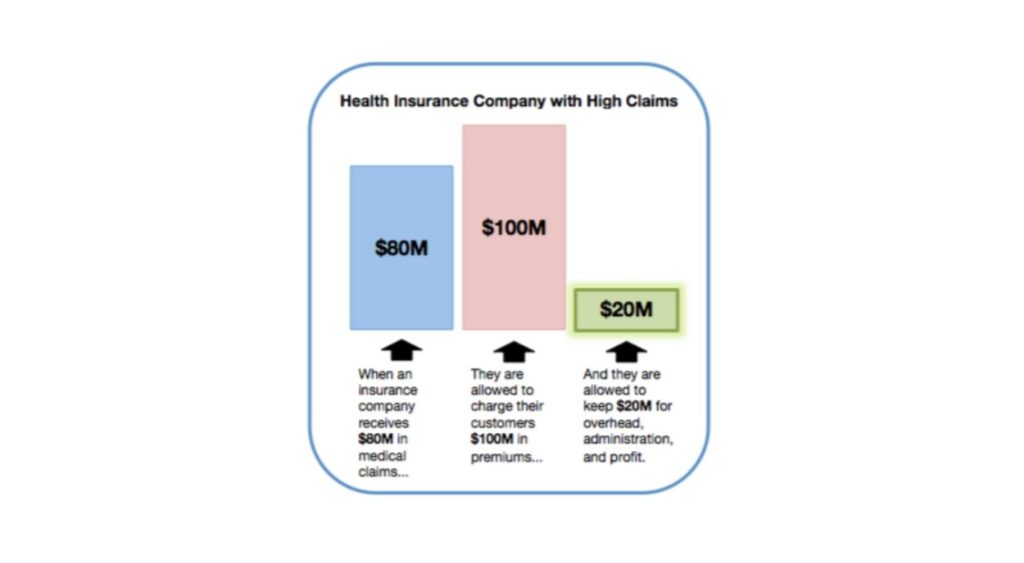

This first graphic shows the 80/20 rule in action. Using simple, round numbers, an insurance company that experiences $80 million in medical claims is legally permitted to charge $100 million in premiums to its customers, leaving $20 million remaining to cover administrative expenses, overhead, and profit.

You may have heard insurance companies declare that they are committed to reducing medical claims. It’s something we hear all the time. And while that may have been a credible position before the 80/20 rule was implemented (and the insurance companies weren’t so limited in how much they could mark up their claims in the form of premiums), now this position seems a little more difficult to believe. Since their markup is limited to 20% of their claims at most, mathematically speaking, it seems they would actually want claims to be as high as possible. The more they pay in claims, the more they charge in premiums, and the more money they get to keep as profit.

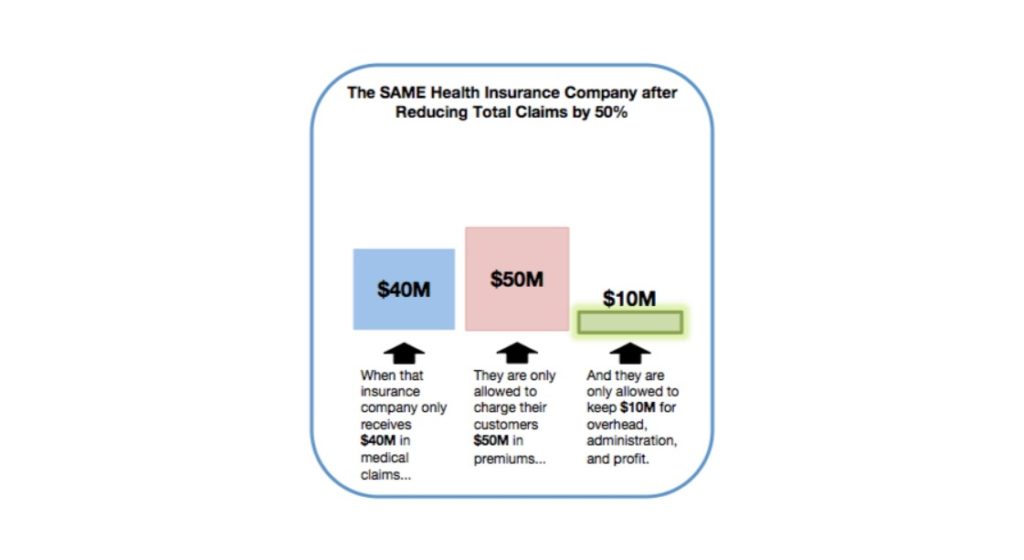

Now let’s take a look at another graphic (again, provided by MyMedicalShopper) that shows what happens to the same health insurance company discussed above when its claims have been reduced by 50%:

Notice anything significantly different between these two graphics? How about the third column? The one that directly impacts how much the insurance company gets to keep for profit? Hmm.

When an insurance company receives $40 million in medical claims instead of $80 million, then they’re only allowed to charge their customers $50 million in premiums. As you can see, this scenario would only leave them $10 million for administration, overhead, and profit. So by receiving less in medical claims, the insurance company actually has less to spend on costs not related to your healthcare or improving the quality of your care. For an insurance company in our quasi-regulated healthcare industry, lower claims mean less profit.

Evidence is showing that introducing a comprehensive price transparency tool to the equation for medical consumers causes medical claims to drop. So it starts making sense why insurance companies aren’t exactly jumping up and down about the increasing transparency of medical pricing. If we consider the situation from a business standpoint, the graphic above shows exactly what would happen to insurance company profits after their total claims have been slashed because their customers started taking advantage of new price transparency technology.

Are our health insurance companies really doing everything they can to help us get all the price and quality information we need to make educated healthcare decisions? Are they really negotiating the lowest reimbursement rates possible with all of the healthcare providers to keep the cost of our care under control?

Maybe you’ve been counting on your insurance carrier to control the cost of your health insurance. But are you still convinced that your insurance company is really motivated to reduce your medical claims?