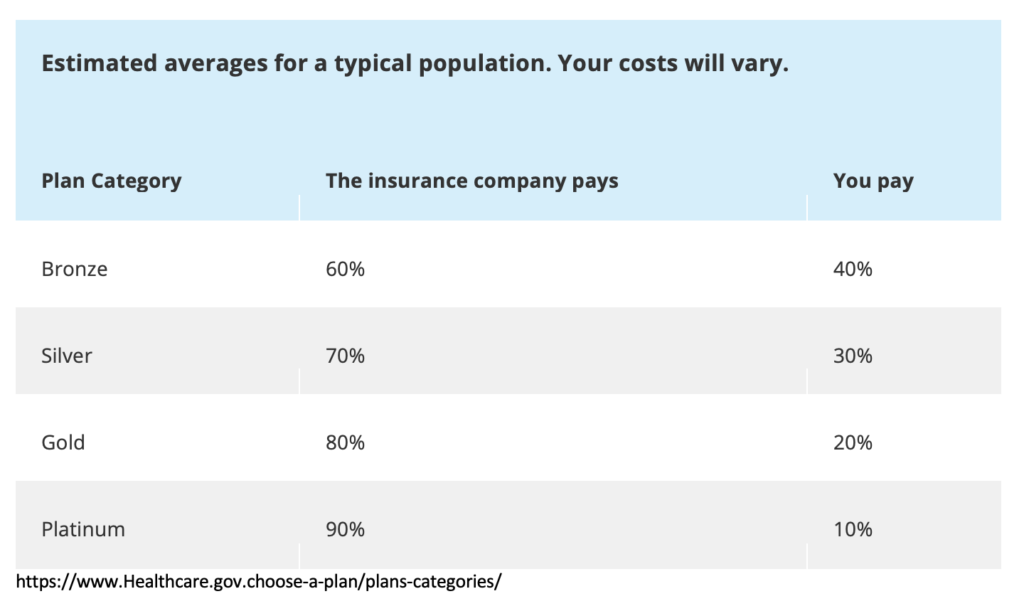

Within health plan design offerings, there are four categories, or metal levels, made available to employers and their employees. These levels are listed by the split of costs between the enrolled individual and the health plan. See chart below:

How you and your insurance plan split costs

The decision process behind enrollment within these plans is based primarily upon healthcare utilization. The leading factor to make a “good choice” of plan selection is, for many, primarily based upon how the individual expects their healthcare utilization to trend for the next year. If healthcare expenses seem likely to be high, then paying more per month as a premium would seem well worth the cost, in order to limit personal exposure to 10 percent of the total bills. The secondary levers impacting the healthcare plan decision focus on costs (independent of expected utilization of services), with the two variables—monthly premiums, and deductible exposure—behaving in an inverse relationship. Put simply, as your monthly premium increases, your deductible exposure decreases.

If an individual worries about high healthcare utilization, the “good choice” would seem be a high-premium, low deductible exposure plan. See the Platinum plan above, where the insurance company pays 90%, with the individual responsible for the remaining 10%.

Considering total cost of health insurance and healthcare, it’s important to understand what the monthly premiums look like for a platinum plan. The average premium for an individual enrolled in a platinum plan comes in at $732 per month, or $8,784 per year. Considering what a person’s total out-of-pocket exposure would look like if he or she were to meet an annual out-of-pocket maximum of $6,500, that individual would have paid $15,284 for the year. That’s surely platinum-level pricing.

So, what should be the driving factors of plan enrollment? First and foremost, deductible security. What does deductible security mean? It means the ability for an individual to confidently meet his or her deductible amount when that person needs care. The second consideration includes the amount spent annually, not monthly, on premiums.

The ultimate set up, of course, would be to ensure the lowest total premium contribution and the lowest out-of-pocket exposure. This would be defined as what? I think it should be called the Diamond Plan. I understand diamond isn’t a metal, but I’m pretty sure diamond is more sought-after than platinum.

Why is a Diamond plan an opportunity for employers and employees? There are two big reasons, expected to take effect by January 1, 2022. The Transparency in Coverage Rule and the No Surprises Act. These two rules create perfect price transparency and processes to mitigate excessive, egregious out-of-network cost exposure.

First and foremost, employer groups with more than 50 enrolled employees, beginning January 1, 2022, will have to publish three machine readable files with the following information made available:

- negotiated rates for all covered items and services between the plan or issuer and in- network providers.

- historical payments to, and billed charges from, out-of-network providers

- in-network negotiated rates and historical net prices for all covered prescription drugs by plan or issuer at the pharmacy location

This represents the first, foundational step towards perfect price transparency. Employers and employees should engage with solutions that can ingest these massive, complex files and provide a seamless user experience output that mirrors the Amazon experience we all so cherish.

Secondly, the No Surprises Act will make it illegal for providers to bill patients for more than the in-network cost-sharing due under patients’ insurance in almost all scenarios where surprise out-of-network bills arise, with the notable exception of ground ambulance transport. Health plans must treat these out-of-network services as if they were in-network when calculating patient cost-sharing.

Patients will no longer be exposed to large surprise out-of-network bills when receiving emergency care or elective procedures or being transported by an air ambulance. Eliminating that perverse leverage has the potential to reduce costs in certain specialties—and, as a result, consumers’ premiums.

Herein lies the innovation of a Diamond plan. Shop for the maximum deductible (that’s right, the maximum deductible) and, with the premium savings generated, fund an HSA account and allow for any additional HRA expenses. This plan design, alongside the assurance from the implementation of the No Surprises Act, helps limit employees’ out-of-pocket exposure, and ultimately, their fear of out-of-network costs that are so egregiously thrust upon them by out-of-network providers. And with the implementation of the Transparency in Coverage Rule, and perfect price transparency, we will slowly be ascending towards an empowered, engaged healthcare consumer.

So, consider the Diamond plan when choosing health insurance for, with, or as an employee. Take the Bronze deductible and premiums, use the savings from monthly premiums to fund an HSA account, and, then, if the HSA money isn’t needed to help pay for medical costs, it remains the employee’s.

-Matthew McCormick, Director of Partner Sales