In part 1 of this series, “The Year of Healthcare Consumerism”, we’ll be defining the current state of healthcare price transparency, a critical piece of the healthcare consumer journey. We’ll review the current regulations requirements, enforcement and oversight, and gaps and opportunities within the market.

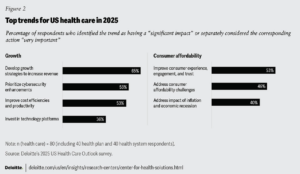

In a recent report published by Deloitte, it was noted that the overarching health care sector themes for 2025 are Growth and Consumer Affordability. These two themes can appear at odds with each other, given that “balancing the growth of margins and profitability while keeping the cost of care in check and navigating an uncertain macro environment could be challenging for health plans and health systems.” With almost 50% of healthcare organization executives recognizing consumer affordability as a key theme, the ability to attract and retain consumers is paramount to growth. Trust and loyalty can be earned by both health systems and health plans through the meaningful pursuit of ethical price transparency. Sitting across the other side of the table from health systems and health plans, over two-thirds of CFOs view health benefit costs as a significant or very significant concern compared to other operating expenses. And the concern does in fact trickle down to consumers, with over half of working-age adults reporting it was very or somewhat difficult to afford their health care costs. The need for ethical price transparency is omnipresent in healthcare.

It goes without saying then that engaging the healthcare consumer and ensuring affordability is a key topic for 2025 across healthcare stakeholders. And in order to understand affordability, there must be a mutual understanding of costs, and that can only be derived from transparent healthcare pricing. Let’s look at two key regulations influencing price transparency in the healthcare market; the Hospital Price Transparency Rule and the Transparency in Coverage Rule.

Price Transparency

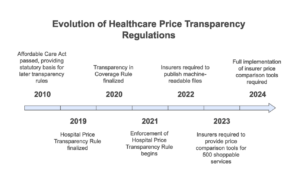

There has been a massive shift brought about by federal regulators since 2021 that has made price transparency a right for healthcare stakeholders, most importantly healthcare consumers. These efforts include the Hospital Transparency Rule and the Transparency in Coverage Rule. Both of these have shifted the concept of transparent healthcare pricing for consumers, hospitals, and insurers and as a result, the healthcare consumer’s experience regarding affordability.

Hospital Price Transparency Rule (Effective January 1, 2021)

In CMS’ final rule, the Centers for Medicare & Medicaid Services (CMS) requires hospitals to publicly post payer-specific negotiated rates online in a “machine-readable” file. In addition, hospitals were required to display pricing for at least 300 “shoppable services” (commonly scheduled services, like imaging or laboratory tests) in a consumer-friendly format. Since its enactment, there have been meaningful updates made to make the information more available, accessible, and usable. Beginning in 2022, CMS updated the penalty structure for noncompliant hospitals to the following;

- Large Hospitals (30+ beds): Can face penalties of up to $10 per bed per day, capped at $5,500 per day, potentially exceeding $2 million per year.

- Smaller Hospitals (fewer than 30 beds): Face penalties of $300 per day.

The above update makes sense, given that the previous penalties were feeble and could easily be offset by the cost of an out-of-network knee repair.

Additionally, CMS provided additional details on how hospitals should structure and label their machine-readable files to ensure consistency, including:

- File Naming Conventions: Encouragement to use standardized naming formats (e.g., “hospital-standard-charges.csv” or “.json”).

- Data Requirements: Clarifying that hospitals must list all five types of “standard charges” for each item/service, including gross charges, discounted cash prices, payer-specific negotiated charges, and de-identified minimum and maximum negotiated charges.

Also included within the updates since 2021 was a recommitment to allowing consumers to engage in healthcare consumerism, with CMS reiterating to hospitals that they must present at least 300 shoppable services in a consumer-friendly format, emphasizing:

- Clarity & Accessibility: Pricing data should be easy to locate on the hospital’s website and clearly labeled so patients can identify costs without extensive searching.

- Accuracy & Completeness: Hospitals cannot omit required data fields (e.g., billing codes, service descriptions, payer negotiations).

CMS released additional sub-regulatory guidance and fact sheets outlining how it monitors hospital websites, responds to complaints, and evaluates compliance, with stricter enforcement and commitment to compliance actions outlined. Some of these enforcement actions include increased audits of hospital websites and threats of public disclosure of hospitals that fail to comply with the rule. Beginning in 2025, three key additional data elements will be required to be added to the machine-readable file, including drug unit of measurement and drug type of measurement, adding modifiers to procedure codes, and estimated allowed amount — which refers to the anticipated reimbursement amount that a hospital expects to receive from a health plan for a particular service.

Unfortunately, there continues to be ongoing challenges concerning compliance with the Hospital Transparency Rule, notably regarding availability and usability. Despite updated guidance, increased non-compliance fines, and the threat of public shaming, many hospitals continue to post data in inconsistent formats or behind multiple clicks, impeding the user-friendliness that CMS envisioned. In a report published in November, the percentage of hospitals in full compliance with federal price transparency rules fell from 34.5% to 21.1%, according to watchdog group Patient Rights Advocate. The lack of compliance can be attributed to the Biden Administration’s lack of oversight, CMS’ (mis)guidance, and lax enforcement, as indicated by PRA Chairman and Founder Cynthia Fisher. Beginning in July of 2024 with the publication of the outpatient prospective payment system (OPPS), hospitals have been allowed to post percentages and algorithms instead of actual prices, leading to further obfuscation of true price disclosure. Additionally, since 2021, the Biden Administration has fined only 15 hospitals out of a possible 1,579 found non-compliant by PRA, and only one of those fines were delivered in 2024.

Transparency in Coverage Rule

The Transparency in Coverage (TiC) Rule was finalized by the Departments of Health and Human Services (HHS), Labor, and the Treasury in October 2020. Impacting most group health plans and health insurance issuers offering coverage in the individual and group markets, the rule includes 2 key requirements. The first requirement, effective January 1st, 2022 with enforcement beginning July 1st, 2022, is the disclosure of two-machine readable files. The first File, referred to as the In-Network File, must display negotiated rates between the plan/issuer and in-network providers for each covered item or service. The second file, known as the Out-of-Network File, must show historic allowed amounts and billed charges for out-of-network providers with key data limits to be met to protect patient privacy. When the Rule was originally proposed, a third-file was required, the Prescription Drug File, which included disclosures related to negotiated rates and historical net prices for covered prescription drugs. This third file requirement was delayed for multiple reasons, including concern whether this requirement potentially duplicated the requirement to report drug costs under the Prescription Drug Data Collection (RxDC) program that was adopted as part of the Consolidated Appropriations Act, 2021 (CAA). But in September 2023, CMS released FAQs About Affordable Care Act Implementation Part 61, which included updates related to the Prescription Drugs File MRF requirements from the Rule. The Part 61 FAQs ended the enforcement deferral period for the prescription drugs MRF. Unfortunately, an enactment and enforcement date has yet to be announced pending a commitment from CMS: “The Departments intend to develop technical requirements and an implementation timeline in future guidance.”

The second key requirement of the Transparency in Coverage Rule is the provision of a web-based cost-comparison shopping tool to help plan enrollees estimate their out-of-pocket costs for specific services under their plan. Beginning January 1st, 2023 plans must offer a cost-comparison tool for at least 500 “shoppable” services. And in the following year, by January 1st, 2024, plans must expand the tool to include all covered items and services. Outlined in the requirements, the Rule explicitly states that the web-based cost-comparison shopping tool must allow individuals to search by specific in-network providers, estimate out-of-network costs, and provide accurate, personalized cost estimates based on the member’s plan benefits (e.g., deductibles, copays, coinsurance). Importantly, the Rule also indicates that “the cost-sharing liability for a particular item or service be calculated based on in-network rates, out-of-network allowed amounts, and individual-specific accumulators, such as deductibles and out-of-pocket limits. However, the Departments clarify that plans and issuers may incorporate additional metrics and analytics beyond this minimum standard: For example, by using complex historical analytics to predict total costs of items and services available through a bundled payment arrangement.”

There have been significant implementation challenges associated with the Transparency in Coverage Rule for a myriad of reasons, including data volume, data complexity, consumer access and usability, and standardization. In-network files can be massive, containing tens of thousands of negotiated rates. In addition to the size of the files, there is still variability in how insurers organize and label data, making cross-plan comparisons difficult. This combination of massive and massively complex machine-readable files make handling, processing, and updating this data monthly a resource-intensive (both capital and human) task. Given that even expert data scientists struggle in wrangling this data to some level of usability, the average consumer must rely on the web-based cost-comparison shopping tool which, depending on how the data is ingested and subsequently displayed, may negatively impact the consumer experience.

Enforcement is shared by HHS, the Department of Labor, and the Department of the Treasury, and across states’ departments of insurance, depending on the specific plan funding approach. Non-compliance carries considerable civil monetary penalties, with potential fines of up to $100 per affected individual, per day, for noncompliance. So far, enforcement and oversight has been near non-existent, with near zero compliance efforts underway. Fortunately, given the incoming administration originally propelled this Rule forward, and the unsustainable cost burden upon healthcare consumers, we may see increased enforcement and oversight by the various regulatory agencies.

Gaps and Opportunities

Most major health plans, if not all, have published machine-readable files regarding their in-network negotiated rates in accordance with the Transparency in Coverage Rule. The majority of health systems, on the other hand, are failing to publish machine-readable files, and as a result, are not complying with the Hospital Price Transparency Rule. Basic cost-comparison shopping tools are being made available to healthcare consumers through health systems, health plans, and third-party vendors, but many often lack the necessary comprehensive pricing data and real-time benefit verification to enable meaningful, accurate, personalized cost-comparison. These shortcomings within these tools could be considered non-compliant with the requirements of the Transparency in Coverage Rule. Important to consider regarding non-compliance, and consistent with actions taken during his first term, President-elect Trump has indicated plans to address surprise medical billing, price transparency, and out-of-pocket costs for consumers.

In order to firmly address healthcare affordability for consumers, a meaningful investment into a compliant cost-comparison tool is paramount. There are three key components to review and audit for this upcoming year. These include:

- Search Functionality

- Allow search by billing code, name, description, or other factors for ALL covered items and services

- Enable filtering by location, provider, and cost-sharing amount

- Support provider network status comparison

- Required Cost Information

- Tracked accumulated amounts toward deductible/out-of-pocket maximum

- In-network negotiated rates

- Out-of-network allowed amounts

- Cost-sharing amounts including deductibles, coinsurance, copayments

- Expected member out-of-pocket costs in consideration of the procedure encounter, not just the procedure

- Items/services excluded from deductible

- Accessibility Requirements

- Internet-based self-service tool

- Paper disclosure available upon request

- Free of charge

- Plain language descriptions

- Real-time responses

Health plans, health systems, and employer groups must consider investing further in consumer-centric, digitally-enabled platforms. Enhancing the consumer experience and mirroring the personalization and customization available within retail, fintech, and entertainment can both lessen friction for consumers and dramatically improve loyalty and trust between consumer and health plan/system. Policy and regulation has laid the groundwork to ensure ethical price transparency, it’s now incumbent upon stakeholders to ensure and exceed compliance for the betterment of American businesses.

In part 2 of this series, “The Year of Healthcare Consumerism”, we’ll be reviewing the other notable regulatory efforts put in place over the past 4 years, including key elements of the Consolidated Appropriations Act of 2021. We’ll review the current regulations requirements, enforcement and oversight, gaps and opportunities within the market, and the reported impact of these requirements upon health plans, health systems, and employer groups.

P.S.For those interested, screenshots of tools currently provided to consumers and examples as to why the tool would be non-compliant are included below. Reach out to learn more to TALON Sales.

A.) All services and procedures must be searchable. Only for very few edge cases would allow a “No Results found in this area” to be an acceptable search result

B.) Zombie Rates – when searching for a cardiac test, there is no logical reason as to why an optometrist would perform this procedure. And that goes for a Bariatric Center performing a knee arthroscopy in the second image below.

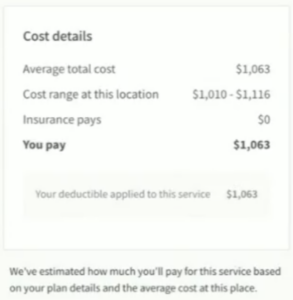

C.) A Total Knee Replacement does not cost $2,217. Failing to consider all likely procedures and services will have a significantly negative impact upon trust between the health plan and consumer

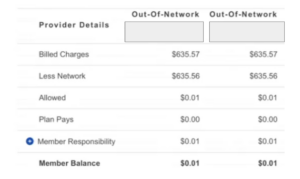

D.) There is no way that for an out-of-network procedure the member responsibility would only be $.01.

E.) Including the procedure costs, but failing to include personalized cost-sharing amounts is not compliant

![]()

F.) Procedures must be searchable both by common language and CPT Code

G.) Averages are not acceptable as a reference point for pricing. Pricing must be derived from the in-network negotiated rates published within the machine-readable files