TALON defines healthcare “price transparency” to be accurate and easily accessible information intuitively presented on the price of health care services and items that helps define the value of those services, enabling patients and other healthcare cost stakeholders to identify, compare, and choose providers based on cost, quality, and convenience.

It is important to note that the definition above includes all the costs that together make up the price. TALON includes all likely procedures expected to be seen on the explanation of benefits (EOB) that the healthcare consumer would be financially obligated to pay.

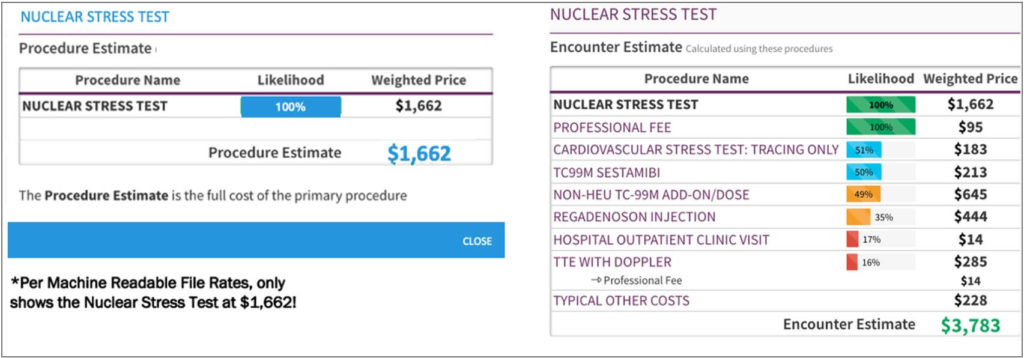

Many providers add additional codes to their billing process. This means that alongside your primary procedure, additional procedures will be performed that you will be financially obligated to pay but may not be aware of until after the procedure has been performed.

As shown in the example below, there are often layers of pricing within procedures. TALON makes these prices transparent to the consumer. Employees, as smart healthcare consumers, want to be aware of and limit their out-of-pocket exposure whenever possible and appropriate. Unlike the traditional procedure estimates provided to patients, TALON’s Encounter Estimate ensures that there be “No Surprises.” TALON’s Encounter Estimate allows healthcare consumers to select the option best for their health based on total cost, overall quality, and convenience (e.g., location).

In every consumer arena, not just healthcare, the full encounter cost is preferable. It enables the consumer to have full confidence in the price they will ultimately pay, the quality of care they can expect to receive and ultimately their perceived overall value of the transaction. Cost alongside quality and convenience are crucial factors when making smart purchasing decisions.

Real healthcare price transparency requires the accurate capture and display of the full cost of the encounter. TALON, leveraging our machine learning system expertise, provides accurate total encounter pricing for plan employees.

The Transparency in Coverage Rule and the No Surprises Act bring price transparency to the forefront, in fact requiring it by federal law beginning January 1, 2022. TALON’s MyMedicalShopper™ served as the prototype for these transformative mandates. The Transparency in Coverage Rule requires that both fully insured and self-funded employers with more than 50 members publish the following three machine-readable files –

- negotiated rates for all covered items and services between the plan or issuer and in-network providers;

- historical payments to, and billed charges from, out-of-network providers; and

- in-network negotiated rates and historical net prices for all covered prescription drugs by plan or issuer at the pharmacy location level*.

Gaining access to the information removes the veil of price opacity set forth by providers and carriers. TALON’s machine learning system and proprietary algorithms ingest, parse, and ultimately avail this data instantly to the medical shopping consumer- exactly as required by the Rule. TALON’s MyMedicalShopper presents the radical price variation between in-network providers network providers and helps the employer and their employees avoid wasteful healthcare spending by making smarter choices.

Having access to the machine-readable files alone doesn’t mean that true price transparency exists. As outlined with the example given above, a full solution must consider any associated, ancillary procedures. TALON does exactly that.

As a significant component of the No Surprises Act, the advent of the Advanced Explanation of Benefits (AEOB) represents significant progression for healthcare consumerism. Payers must send participants, upon request, an AEOB before the scheduled care is provided. In most cases, this AEOB is due at least 3 business days before such service is to be furnished. The details included within the Advanced EOB are as follows –

- whether or not the provider or facility is in-network;

- if in-network, the contracted rate under the Plan for such services (based on billing and diagnostic codes).

- if out-of-network, a description of how the individual can obtain information on in-network providers of those services

- a good faith estimate of the cost received by the provider or facility based on the billing and diagnostic codes

- the amount the Plan is responsible for paying

- a good faith estimate of the amount of any cost-sharing the enrollee must pay

- a good faith estimate of the amount the enrollee has incurred toward meeting the limit of financial responsibility under the Plan (i.e., the deductible and out of pocket maximum)

- in the case of a service subject to medical management techniques (e.g., step therapy, prior authorization), a disclaimer that the service is subject to medical management

- a disclaimer that the information is only an estimate and subject to change

Imagine receiving an Advanced EOB, and then a second notification from a carrier-agnostic and provider-agnostic source whose primary aim is to mitigate your out-of-pocket exposure and help you navigate to cost-effective care that is right for you. This second notification includes alternative, convenient, high-value in-network providers, with encounter pricing for the same exact procedure(s) you need, but at a lower cost, without sacrificing quality. The notification also highlights the amount of wasteful spending mitigated; the amount of savings you could realize by navigating to a more cost-effective provider, and even the potential rewards you can earn from choosing a lower cost provider that also meets your quality and convenience criteria.

TALON does precisely that, today. We call it No Surprise Shoppingtm.

*Enforcement of the pharmacy file will be postponed, pending a review-and-comment period, considering similar requirements from the NSA