When employers and employees share transparent information, fair incentives, and a smooth way to earn rewards, everyone makes smarter choices — TALON’s MyMedicalRewards and TALONPay make that alignment real.

Why Alignment Matters Now

For millions of American employees, healthcare decisions have become one of the most confusing and financially stressful parts of life. Even the most diligent consumers struggle to understand what care will cost until after they receive it. It’s an untenable situation in an era where financial wellness and workforce engagement are deeply intertwined.

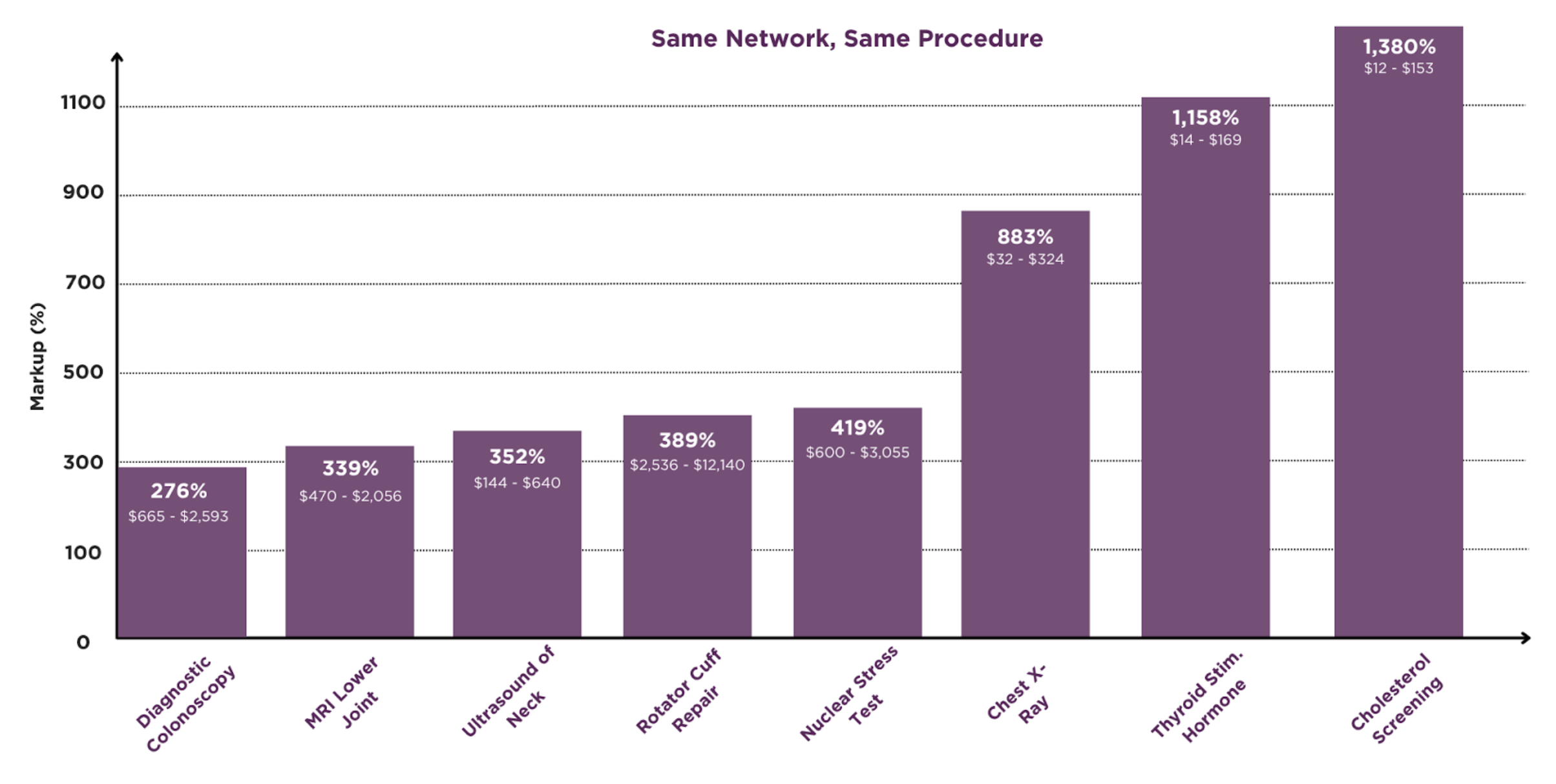

Meanwhile, employers, especially those offering self-funded health plans, are watching healthcare costs rise faster than wages. And it’s attributable to the cost of healthcare, where in-network rates for the same exact procedure can vary by 2x up to 15x. That kind of price spread wouldn’t be tolerated in any other area of business.

Yet in healthcare, it’s normal.

The solution isn’t more cost-shifting or plan complexity. It’s financial alignment, where employers and employees both benefit from smart healthcare decisions through a shared system of incentives and transparency.

The Misalignment Problem

Financial alignment in employee benefits means that both employers and employees have access to transparent, discoverable information and share in the incentives for value-based choices and rewards received through simple, trustworthy embedded experiences.

Unfortunately, today’s benefits environment is often the opposite:

- Opaque pricing: Members can’t see real prices, making it impossible to compare options.

- Complex benefit design: Deductibles, coinsurance, and networks confuse rather than guide.

- Friction at the point of reward: Unexpected hoops and fragmented systems discourage engagement.

Consequences for Employers and Their Teams

- Rising per-member per-month (PMPM) costs

- Employee dissatisfaction with healthcare affordability and access

- Increased wasteful spending as a result of missed opportunities to guide members toward high-value providers

TALON’s Approach to Alignment

TALON addresses the root causes of misalignment by making cost-smart behavior rewarding and effortless.

MyMedicalRewards: Aligning Incentives with Insight

What it is:

A structured, plan-compliant incentive program that rewards members for choosing high-value care options.

How it aligns incentives:

Employees earn meaningful rewards for smart healthcare consumerism. Employers lower total cost of care by steering to high-value providers, without reducing access or quality.

Member journey:

- Price shop for a covered service

- Select a high-value provider

- Complete the service

- Receive a reward directly through the platform

Employer benefits:

- Measurable steerage toward high-value providers

- Configurable rewards aligned with plan goals

- Transparent reporting on savings and engagement metrics

TALONPay: Simplifying Payment and Reinforcing Smart Choices

What it is:

An in-app, multi-purse debit card experience that streamlines member rewards while honoring plan rules.

How it aligns incentives:

TALONPay reinforces transparency at the moment of decision, removes incentive friction, and supports accurate, timely rewards for increased engagement

Member flow:

- Estimate care cost and benefits

- Confirm price before service

- Receive reward directly into the designated TALONPay account (HSA / HRA /debit card)

- Receive automated documentation for both member and employer records

Employer benefits:

- Fewer obstacles to earn rewards

- Improved member experience and trust

- Enhanced engagement and employee health

Alignment in Action

Scenario A: Shoppable Imaging (e.g., MRI)

A member searches for an MRI and sees wide price variability:

- Benchmark provider price: $1,100

- High-value provider: $650

- Reward to member: $225

Net employer savings: ($1,100 − $650) − $225 = $225

Member win: Reward + lower bill, same quality care.

The benchmark provider price in the example above is set at the median with 50% of the difference between the benchmark and the high-value provider available for a reward to the employee. If we look at the highest cost provider where an employee could have sought care, the net savings compound dramatically.

Net employer savings: ($2,000 − $650) − $225 = $1,125

Multiply that across hundreds of eligible events and alignment delivers exponential results.

How Alignment Drives Outcomes

- Transparency → Employees understand real prices

- Informed choice → Members select higher-value care

- Incentives → Reinforce cost-smart behavior

- Steerage → More care delivered in optimal settings

- Lower total cost of care (TCOC) → Sustainable savings and satisfaction

We’re in This Together

Achieving employee–employer financial alignment isn’t just about cutting costs. It’s about restoring trust, reducing friction, and sharing in the wins.

When employees are rewarded for making smart choices and have the tools to earn rewards easily, they become active participants in managing healthcare costs. And when employers enable that participation through MyMedicalShopper, MyMedicalRewards, and TALONPay, alignment becomes more than a concept. It creates a culture of win-win-win.

Key Takeaways

- Financial alignment turns employees into empowered partners in cost containment.

- Incentives (MyMedicalRewards) and embedded rewards experience (TALONPay) work hand in hand.

- Trust, fairness, and clarity make alignment sustainable.

Ready to align incentives and reduce waste?

Schedule a TALON demo today and request your custom ROI projection for MyMedicalRewards and TALONPay.