In the next blog post within the TALON price transparency series, we will highlight the impact of price transparency already being felt by employers and employees, and what it might mean for fiduciaries going forward.

Introduction to Blog Series:

Transparency in healthcare pricing has finally arrived with the passage of January 1st, 2024. The series of actions that have led us to this point goes as far back as the implementation of the Affordable Care Act, but more recently include the implementation and enforcement of the Hospital Transparency Rule, the No Surprises Act as part of the Consolidated Appropriations Act of 2021, and most notably (although not widely covered) the Transparency in Coverage Rule.

We’ve seen enforcement and resultant fines upon healthcare providers due to non-compliance with the Hospital Transparency Rule. Given the bipartisan and bicameral support healthcare transparency receives, active enforcement of the Transparency in Coverage Rule requirements will be seen throughout 2024 into 2025, where non-compliant actors will face business crippling penalties, loss of trust and credibility, and reduced revenue. The age of opaque healthcare pricing is nearing its end as the exorbitant healthcare costs borne by consumers have served as an important impetus for systemic change in the U.S. healthcare system.

With transparent healthcare pricing now available, what opportunities will come to light as a result of this massive data? For the first time in the American Healthcare System, symmetrical pricing information between and amongst stakeholders is publicly available. Therefore, the question must be asked – Who will recognize this opportunity and leverage it to their benefit and advantage?

In this blog series, it was highlighted why incorporating healthcare price transparency data will provide competitive insights and symmetrical information in the market for all key stakeholders.

In the previous blog post within this series, we highlighted that consumer navigation and steerage within the complex landscape of the American Healthcare System used to mirror the days of the sextant and the study of the stars. As much as the consumer may get to where they need to be, they inevitably face significant confusion, struggle, frustration, and in some cases, their financial downfall. Now, healthcare pricing navigation tools allow the consumer to confidently navigate throughout their journey.

In our third blog post, we will highlight the impact of price transparency already being felt by employers and employees, and what it might mean for fiduciaries going forward.

Duty of Prudence

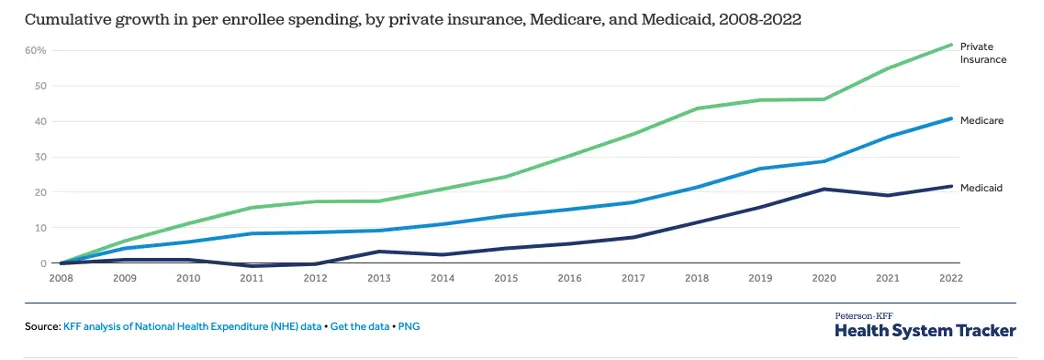

Over $1.3 trillion is spent on private health insurance, with per enrollee spending by private insurers growing by 61.6% from 2008 to 2022. The primary reason for this increase in per enrollee spending is as a result of the increase in healthcare prices, with the Consumer Price Index for medical services growing at an average rate of 3.1 percent per year compared to 2.6 percent per year for the Consumer Price Index for All Urban Consumers. Prior to 2022, employers and employees had very little access to understand expected healthcare costs for services and procedures, but that all changed with the Transparency in Coverage Rule.

The Transparency in Coverage Rule has five goals, as listed below;

- Establish a market-driven healthcare system

- Enable comparison shopping

- Expose real-time pricing information and out-of-pocket liability

- Stabilize and reduce the price of healthcare services

- Empower, inform, and incentivize action from consumers

The pursuit of these goals upon plan sponsors began July 1st, 2022 when the first phase of the Rule became enforceable with the publication of two machine-readable files (In-Network Negotiated Rates and Out-of-Network Historical Billed Amount). The pursuit continued into 2023 and 2024 when the second and third phases of the Rule required that plan participants be equipped with a cost-comparison shopping tool for 500 identified items and services (2023) and then all covered items and services (2024). Concurrently, enforcement of the Consolidated Appropriations Act of 2021 had begun, which placed plan fiduciaries under the microscope in how they approached health plan costs as fiduciaries. These two combined efforts led to the expectation that eventually, plan fiduciaries may be put into the legal spotlight if they fail to practice their fiduciary duty of “loyalty” and “prudence” in managing healthcare costs.

The sentiment regarding these Rules was that sometime in the distant future the ax was going to fall upon fiduciaries, as it had done in the retirement space with the passage of 408(b)(2) disclosure requirement. Surprising most within the Employer-Sponsored Health Insurance industry, the catalyzing event took place on February 5th, 2024, when a groundbreaking lawsuit was filed by a class of Johnson & Johnson (JNJ) employees against JNJ and the Pension & Benefits Committee, as well as the committee members. Less than three years since these combined efforts took effect. Notably, the class action complaint lodged against JNJ alleges that the company paid over $10,000 for a medication readily available on the market for $50, nearly a 200% difference. The allegations point to a complete and utter failure by the group’s fiduciaries. Unfortunately, this type of variation isn’t uncommon within healthcare, whether for procedures or prescriptions, as evidenced by the differences in negotiated discounted rates for the same procedure between in-network providers for a large payer in Massachusetts.

| Procedure | Boston (50-mile radius) | ||

| Low Price | High Price | Variation | |

| Diagnostic Colonoscopy (45378) | $665 | $2,593 | 390% |

| MRI Lower Joint (73720) | $470 | $2,056 | 437% |

| Ultrasound of Neck (76536) | $144 | $640 | 444% |

| Rotator Cuff Repair (23410) | $2,536 | $12,140 | 478% |

| Nuclear Stress Test (78452) | $600 | $3,055 | 509% |

| Chest X-Ray (71046) | $32 | $324 | 1009% |

| Thyroid Stimulating Hormone (84443) | $14 | $169 | 1207% |

| ER Visit (99283) | $129 | $1,564 | 1212% |

| Cholesterol Screening (80061) | $12 | $153 | 1275% |

How does the above table impact a fiduciary? A key element in determining if a fiduciary has met their duty of prudence considers how they have exercised care, skill, prudence, and diligence in the management and administration of the plan. This is paramount when selecting plans and network arrangements.

What should an employer group consider when strategizing for their renewal process? The primary considerations include:

- Mitigating disruptions to employees’ provider network options

- In-network providers have met the health plan’s quality standards.

- The fees and expenses associated are reasonable, necessary for the plan’s operation, and not excessive for the services provided.

The first factor, focused on the provider network options, can be evaluated by the employer group, understanding where employees are seeking care currently and how the plan would be able to assure that there isn’t a disruption to that care being received. Employers face challenges with the second and third factors, focused on quality and costs. Although there are fixed costs associated with the administration of the plan, the variable costs, notably those associated with services and procedures received by employees, are less available for comparison. That is, until the passage of the Transparency in Coverage Rule and Consolidated Appropriations Act of 2021.

To reiterate, the Transparency in Coverage Rule requires employer groups to publish a machine-readable file that captures the in-network negotiated rates for all covered items and services. The Consolidated Appropriations Act removes the prohibition of gag clauses, and as a result, allows employers to access claims data for their group. These two sources of information allow for unparalleled insight into healthcare costs and provide actionable insights into cost containment.

How do employer groups know if they made the most prudent decision concerning their plan and network arrangement? From a financial perspective, it would only be made possible if an employer group could compare the costs of services received by employees over the past year and have each of those claim lines “re-shopped” against the most cost-effective provider in the network. The difference between where care was received and the associated costs and where care could have been sought at lower costs highlights hindsight bias, but more importantly, significant financial opportunity. For the average employer group, it’s estimated that upwards of 41% of healthcare spending is wasteful in that, with utilization remaining constant, the significant price variation between in-network providers for the same exact procedure leads to ineffective spending.

Going beyond a hindsight analysis of claims, employers should also understand the impact of their network and the contracted rates that they’re exposed to. Ideally, an employer group, in practicing their fiduciary duty, should conduct an annual report that highlights what could have been spent upon applicable claims where an alternative insurance payer has a negotiated rate at an in-network provider. For instance, if Payer A and Payer B have contracts with Provider C, what is the impact of the difference between these negotiated rates of procedures? Employers, in practicing their fiduciary duty, should know if Payer A has a greater range of negotiated rates, and as a result, increase the likelihood of wasteful spending.

Regardless of the outcome of the Johnson & Johnson class action lawsuit, there will be a transformation in fiduciary practices concerning employee health plans. Fiduciaries must hold themselves to standards of prudence, loyalty, and act solely in the interest of plan participants and beneficiaries with the exclusive purpose of providing benefits to them. Forewarned is forearmed. How will you exercise prudence and diligently audit your plans and networks? Will you leverage the compliance opportunities made available to you, or will you continue the status quo, stumbling through the opacity of your group’s healthcare spend?